What is it ?

Latency arbitrage involves a trading scenario where one participant gains a competitive edge over others by accessing a source of quotes more rapidly. This advantage stems from the participant's order transmission point being physically closer to the source compared to other participants.

Evolution of Latency Arb strategies

The abundance of global markets has facilitated the simultaneous trading of commodities, currencies, metals, and cryptocurrencies across numerous platforms. This distributed bidding phenomenon arises from geographical disparities, time zone discrepancies, and variations in production locations. Consequently, prices for the same instrument fluctuate between different trading platforms, giving rise to latency arbitrage, wherein traders purchase products at one exchange and sell them at another for a slightly higher price. This practice hinges on swift buying and selling, also known as arbitrage delay or high-frequency trading.

High-frequency trading emerged following the Securities and Exchange Commission's approval of electronic trading platforms in 1998. Initially transacted within seconds, high-frequency transactions have evolved to occur within milliseconds, and sometimes even microseconds, by 2010. Despite accounting for less than 10% of market transactions in the early 2000s, high-frequency trading has seen a steady increase in market share over time. According to the New York Stock Exchange, trade volume surged 2.6 times between 2005 and 2009, with high-frequency traders contributing to this growth. Currently, latency arbitrage constitutes over 80% of all financial market trading, with major banks and financial institutions likely engaging in high-frequency trading alongside traditional methods.

As high-frequency trading strategies gain widespread adoption, profiting from them becomes increasingly challenging. Frederi Viens of Purdue University estimated that profits from all high-frequency trading in the United States dwindled from $5 billion in 2009 to $1.25 billion in 2012. Nevertheless, despite heightened competition, latency arbitrage remains one of the most lucrative avenues for earnings in financial markets. Notably, trading algorithms in this domain have been known to sustain profitability over extended periods without experiencing any losing days.

Latency Arbitrage in the world

Imagine two individuals visiting a fruit market where they encounter two apple vendors. Let's say the first vendor sells apples for 20 € while the second one sells them for 22 € . Assuming the apples are identical, eliminating any quality-based decisions, buyers typically opt for the cheaper option initially, purchasing apples from the first vendor until they are depleted before considering the second vendor's higher-priced apples.

Now, the first buyer heads to the market with the intention of purchasing apples priced at 20 €. However, unexpectedly, another buyer rushes from the opposite direction, securing all the peaches priced at 20 € before the first buyer can reach them. The second buyer promptly resells these apples on the spot, setting the price at, for instance, 21 €. Importantly, the resale price must exceed the purchase price but not surpass the price set by the next vendor. If it exceeds, buyers will opt for the 22- € apples ; if it falls short, there will be no profit.

How it works in the market

The concept remains consistent: when there's a favorable market price, swift acquisition is key to promptly reselling at a higher rate. This is facilitated through diverse technical and geographical means, employing specialized software, equipment, and cutting-edge technologies, including fiber optics, to attain a near-instantaneous and highly reliable advantage.

In the pursuit of profit, financial institutions, as listed by Forbes, engage in costly contracts with stock exchanges, positioning their servers within the same premises as the exchange's servers—an arrangement known as collocation. While this service is available to all contractees, disputes often arise regarding the equality of conditions, particularly concerning cable lengths from equipment to exchange servers.

The trading algorithm equipment comprises highly specialized, custom-made components, often utilizing DMA and high-frequency chips, and is coded using low-level programming languages like assembly language.

Beyond cable connections, market data transfer methods include airwave transmissions, employing private microwave radio networks spanning hundreds of kilometers and costing tens of millions of dollars. These networks, optimized for minimal signal delay, facilitate swift reactions to market events, such as unforeseen decisions by governing bodies or fluctuations in trading performance across different regions and exchanges.

For instance, in cases where the same instrument is traded on different exchanges, such as the DAX on the Frankfurt and London stock exchanges, a colocation on the London Exchange and a direct radio relay to the Frankfurt Exchange enable faster responses to events impacting the German economy.

Import for retail traders

It's conceivable to capitalize on this market inefficiency without needing millions in capital. Technically, the approach remains the same: modify two terminals—one serving as the primary source of quotes and the other as the recipient of trading orders. To ensure instantaneous quote verification and execution without the loss of milliseconds, the entire system must be implemented using one of the faster, statically typed, and compiled programming languages like C/C++, Java, or C#.

By amalgamating two terminals and utilizing different brokerage accounts, a single operational system is established. However, it's evident that competing with those who have collocations on major stock exchanges or engage in arbitrage between them is impractical. High-frequency traders in these markets have decades of experience and have invested substantial sums in their systems and algorithms, making them difficult to surpass.

For those seeking opportunities, smaller exchanges often overlooked by institutional funds, forex brokers, and cryptocurrency exchanges present viable options. The key considerations here are:

Infrastructure

Determining the equipment needed depends on the type of trading involved. For manual trading, an average home computer suffices, but for other strategies, more sophisticated setups are required.

When optimizing your setup, pinpointing the location of the broker's server where you'll be sending orders is crucial. Renting a dedicated server closest to the broker's server is ideal, granting full access to allocated resources. Unlike virtual servers where resources are divided among multiple users, a dedicated server provides direct hardware access, ensuring optimal performance. Virtualization software enables overselling, dividing resources among multiple virtual servers, often leading to resource shortages when demand peaks.

Direct access to exchanges or APIs, preferably using protocols like FIX or PLAZA2, is desirable for executing trades swiftly and efficiently. Lack of direct connections may necessitate reliance on exchange-specific trading terminals or a combination of direct access and terminals. In cases where exchanges offer only web interfaces for trading, automation becomes more complex, requiring parsing and automating actions on web pages. If a broker lacks API connections or web interfaces, it's advisable to seek alternatives better suited for automation and efficient trading strategies.

Latency Arbitrage for Forex Markets.

The foreign exchange (FX) market operates in a decentralized manner, drawing liquidity from numerous suppliers worldwide. Typically, there are approximately two dozen liquidity providers for forex globally. Interestingly, forex brokers often don't serve as liquidity providers themselves. Instead, larger brokers sell their orders to smaller brokers, resulting in a varied composition of liquidity sources among brokers. For instance, a broker may blend liquidity from its clients with that of a supplier before selling it to another broker. However, if a liquidity provider offers an application programming interface (API), it can serve as a faster source compared to dealing with a smaller broker.

Which brokers

Currently, three models of operation are recognized among forex brokers:

- Market-Maker Brokers: These brokers obtain price quotes from a source and simultaneously act as the counterparty in transactions. They profit when traders lose. Market-maker brokers are notorious for not paying out winnings to clients and often introduce obstacles like slippage and requotes. Some impose unusual restrictions on trading activities, such as banning certain strategies like arbitrage.

- Straight Through Processing (STP) Brokers: In this model, brokers do not participate as a counterparty in client transactions. Instead, they route all trades to liquidity providers. STP brokers earn revenue primarily through transaction fees, either included in the trade price or charged separately. They often offer trading at the prices provided by liquidity providers.

- Hybrid System: Many brokers operate under a mixed system, where they partially send trades to liquidity providers and partially act as counterparties themselves. Initially, transactions of new clients may be managed internally. If a client consistently profits, their trades may be directed to liquidity providers to mitigate the broker's risk.

Regulatory oversight helps mitigate non-trading risks. Regulated brokers offer clients important protections, including:

- Segregated accounts to keep client funds separate from the broker's funds.

- Deposit insurance to reimburse clients in the event of broker insolvency.

- Requirements for brokers to use authorized liquidity providers and refrain from acting as the counterparty in client transactions.

These measures render dishonest broker practices futile, while deposit insurance mandates rigorous oversight from regulators to ensure client protection.

Nehcap LatArb System

Nehcap.com operates a Latency Arbitrage (LatArb) system, spearheaded by a team of PhD scientists dedicated to crafting and managing advanced mathematical trading platforms with our own capital. We've structured this system to extend an opportunity for clients to connect their accounts and generate profits while paying a nominal fee.

Our LatArb system specializes in exploiting latency differentials between slower brokers and our exceptionally swift PRIME-XM and LMAX trading feeds. These feeds, among the fastest in the trading sphere, leverage collocation to access market prices milliseconds ahead of the competition. Typically costing upwards of 10,000€ per month, Nehcap assumes this expense, making the LatArb system accessible to retail clients at an affordable purchase fee.

Installation

Once the investors buys the system, our team will take your FIX login details which are provided by the broker and fill it into the Latency Arbitrage software system that is running our systems. The system is simply a amalgamation of fundamentals explained above. Basically the Latency system will take the quotes from collocated price feed of LMAX/ PRIME-XM and compare it to slower FIX broker account of the client. It is then able to send the trades with stops and targets and controlled slippages using IOC orders. Everything is fully monitored and minutely managed by our team.

Performance

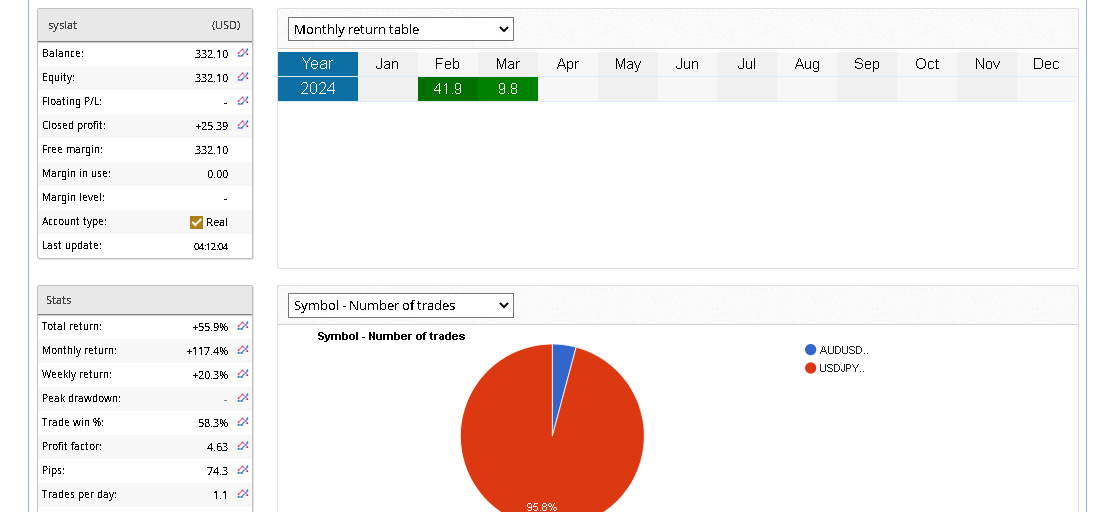

Trading started on 18th Feb 2024. Performance is impressive. Live link available for checking.

Cost

Launch Price = 3900 € is valid till 15th March 2024. Next price = 5300 €

Price includes all future updates and continuous monitoring on our collocated VPS at LD4. All you need to do is to open a broker account who provides the FIX details and a broker who is not collocated at LD4. Large number of brokers are NOT collocated.

To start. send a request by clicking submit below