Fed’s Control Over the Market Crash

…

This is a premium post.

[s2If !current_user_can(access_s2member_level4)]Please register for FREE REGISTER to read full post below containing analysis. In case of any error or you think you are not able to read the full post below, please email us at support#nehcap.com [lwa][/s2If] [s2If current_user_can(access_s2member_level1)]

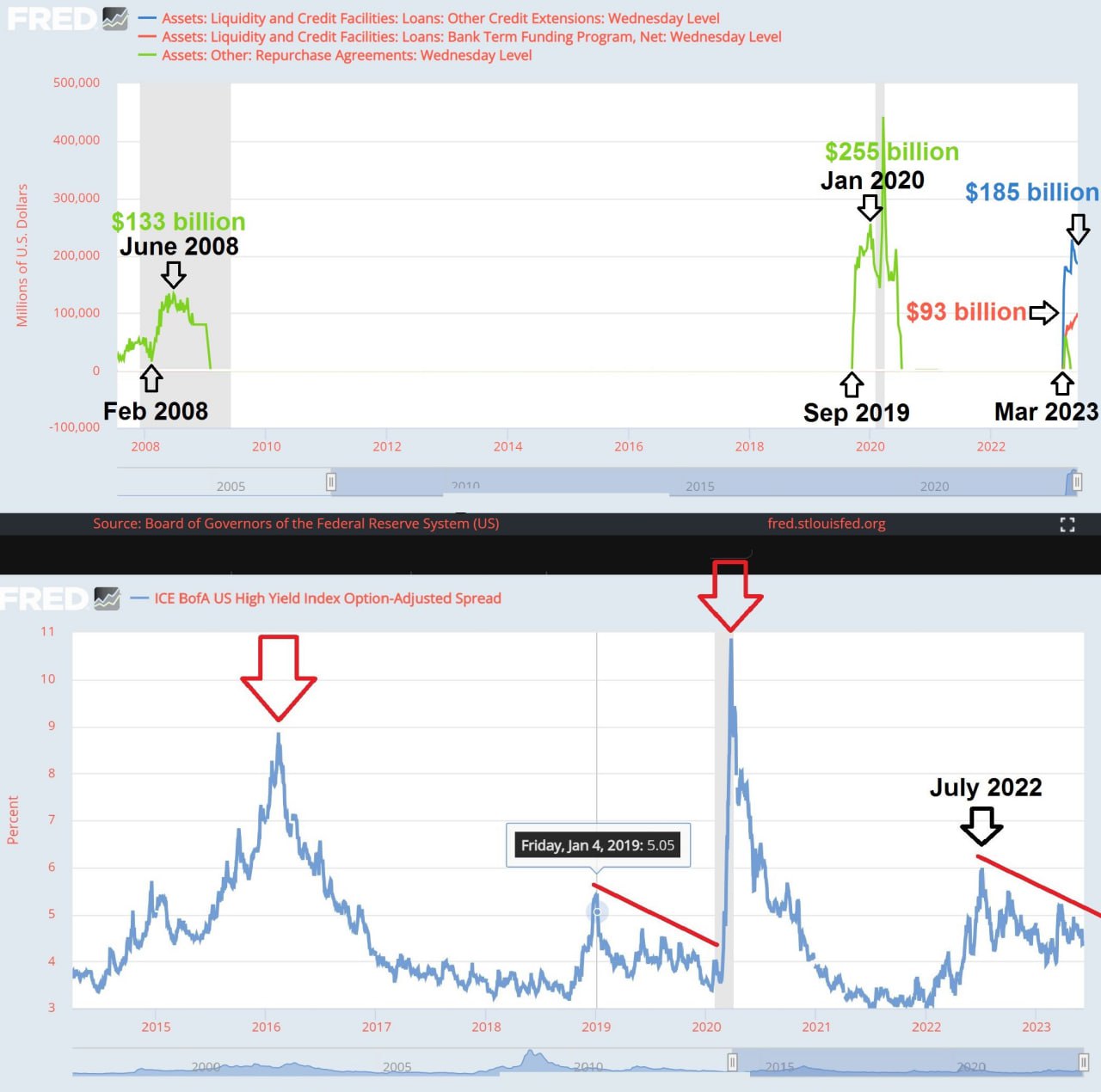

The Federal Reserve intervened in the overnight market during the 2008 and 2020 financial crises by providing liquidity when banks stopped lending to each other. This delay in crisis occurrence gave the Fed complete control over when the crash happened. The Fed’s interventions to bail out the banking sector now exceed the funds allocated before the 2020 financial crisis. The recently created Other Lending Facility and Bank Term Financing program amounts to $278 billion, which is higher than both 2020 and 2008 allocations (inflation-adjusted). When the Fed decides to crash the market, a reduction in liquidity under the Fed’s Term Financing Facility and Other Credit Extensions credit lines would be an indicator. This reduction could be as high as -20% to -50%. [/s2If]

Nehcap Expert Advisor

The NEHCAP MT4 EA is high quality professional trading system geared to generate returns without using GRID or martingales. Each trade has strict risk per trade parameter. The pairs under management include EURUSD, GBPUSD, AUDCAD, AUDNZD,GBPAUD, EURAUD, EURCAD, CHFJPY and many more.

The system is trading live: LIVE ACCOUNT TRACKING

You can run it free. Apply for a free trial and track our account. Buy the system or use profit share mechanism to generate returns on your MT4.

Join Our Telegram Group