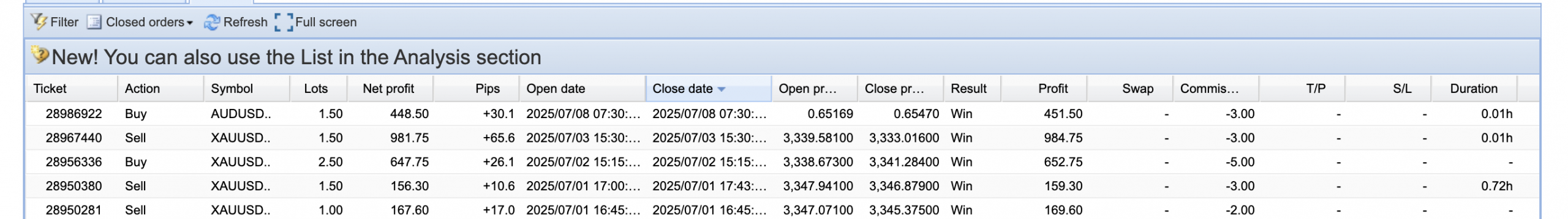

AUDUSD trade taken at the stroke of data release. The system access the data release via superior data feeds premium ones programmatically and is able to place trades using FOK orders thus ensuring slippage free execution.

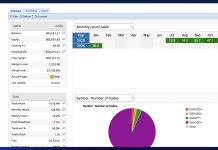

Check the AUDUSD trade

he top trade in the list is an AUDUSD trade executed as part of a High-Frequency Trading (HFT) strategy during the RBA (Reserve Bank of Australia) rate release. Here are the key details:

- Ticket: 28986922

- Action: Buy

- Lots: 1.50

- Net Profit: $448.50 (after accounting for a $3.00 commission)

- Pips Gained: +30.1 pips

- Open Price: 0.65169

- Close Price: 0.65470

- Open Date/Time: 2025/07/08 07:30

- Close Date/Time: 2025/07/08 07:30:… (same as open time, with a duration of 0.01 hours, or ~36 seconds)

- Result: Win

- Slippage: None (execution was instantaneous, as expected in HFT)

Key Observations:

- HFT Execution:

- The trade was opened and closed within seconds (0.01 hours) around the RBA news release, typical of algorithmic HFT strategies that capitalize on volatility and liquidity surges during high-impact events.

- The absence of slippage indicates optimal latency and execution quality, likely achieved through colocated servers or direct market access (DMA).

- Profitability:

- Captured 30.1 pips in a single move, translating to $451.50 gross profit (before commissions).

- The high lot size (1.50) suggests aggressive positioning, but the rapid exit mitigates risk.

- Context:

- AUDUSD is highly reactive to RBA rate decisions, making it a prime candidate for HFT strategies during such events.

- The win aligns with the “buy the rumor, sell the news” pattern or a liquidity-gap fill, common in HFT.

Why This Stands Out:

- Precision Timing: Entry/exit at the exact same minute marks flawless algorithmic execution.

- Zero Duration Risk: Unlike swing trades, HFT avoids overnight swaps or macroeconomic risks.

- Scalability: Such trades are repeatable across multiple instruments/news events with low drawdown.

This trade exemplifies a well-optimized HFT system leveraging low-latency infrastructure and event-driven volatility.

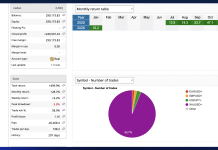

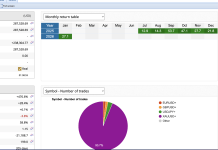

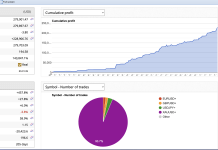

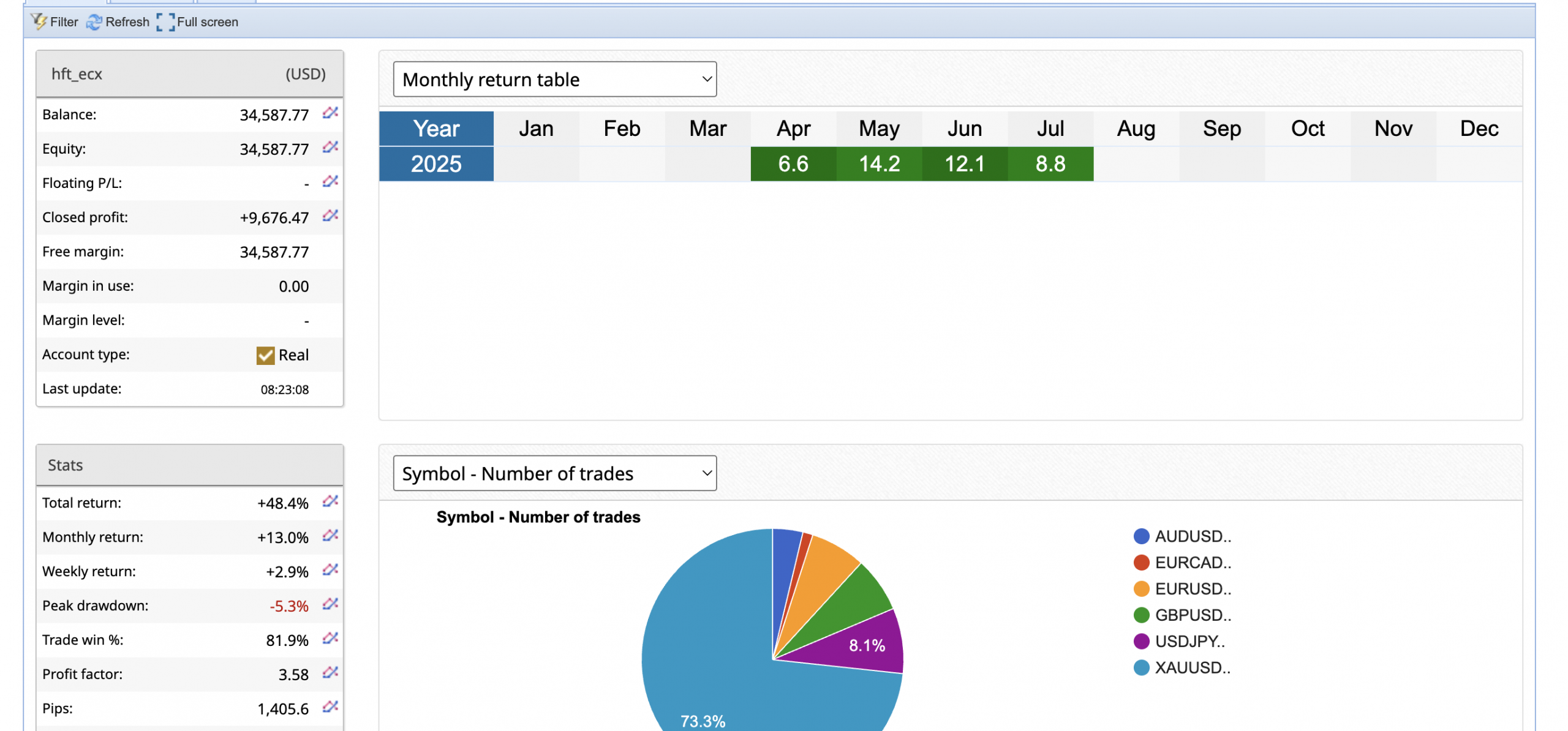

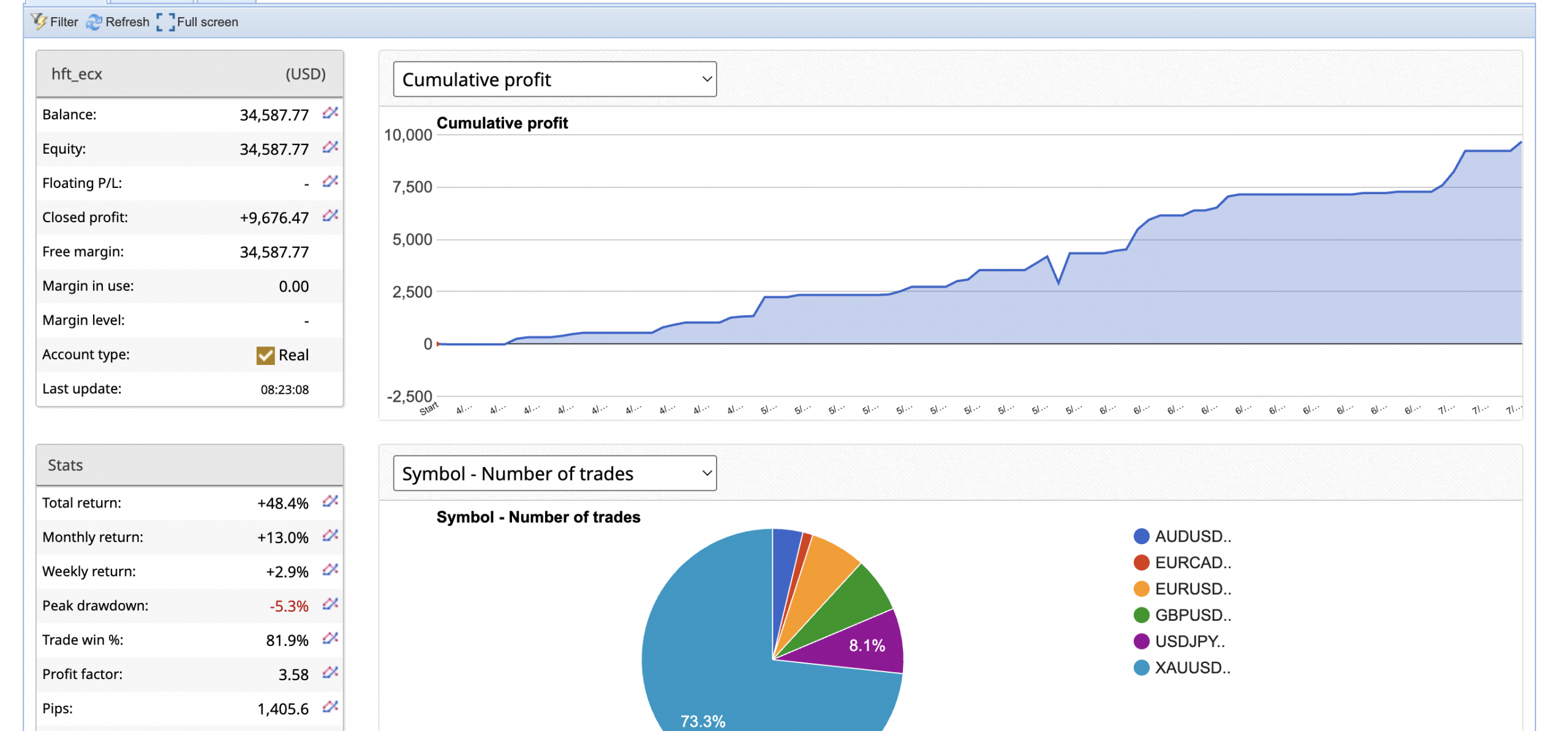

HFT_ECX July trading returns

Observe how with high speed trades entered and closed. These are possible only with HFT system.

CONTACT US IMMEDIATELY IF YOU WISH TO START THIS SYSTEM. ITS NEW SO TAKE ADVANTAGE KNOWING IT RUNS ON SAME PLATFORM AS HFT_FIX: Contact US

HFT_ECX is the elite weapon for next-generation news traders. Engineered with three proprietary algorithms, this system delivers an unbeatable speed edge – executing trades milliseconds before major economic releases hit mainstream feeds. By simultaneously scanning multiple premium news wires, HFT_ECX’s smart routing technology:

1️⃣ Instantly identifies the fastest signal source (discarding slower duplicates)

2️⃣ Auto-triggers precision orders across FX, equities and commodities

Why HFT_ECX dominates:

⚡ Multi-platform aggression: Seamless integration with jForex, cTrader & FIX API

⚡ Dual-account warfare mode: Perfect for hedging strategies across accounts

⚡ Slippage reversal tech: Converts traditional losses into strategic advantages

Live account: HFT_ECX

Get your HFT_ECX now by simply email us at support@nehcap.com or filling the form: Contact US

You only need your FIX-API login details to connect. Simply get them below at either of the brokers:

🌐 VPS Partner: FXVPS.BIZ (For blazing-fast execution)

Once you have registered above at either, then request the support of the broker to issue FIX-API for your account. Once you have it, you will be ready for HFT_ECX.

CONTACT US IMMEDIATELY IF YOU WISH TO START THIS SYSTEM. ITS NEW SO TAKE ADVANTAGE KNOWING IT RUNS ON SAME PLATFORM AS HFT_FIX: Contact US