The Power of Trading News at Microsecond Speed

In financial markets, speed is the ultimate edge—especially when trading around high-impact economic news. HFT_ECX is a next-generation high-frequency trading (HFT) strategy designed to exploit price movements in EURCAD, XAUUSD (Gold), and GBPUSD milliseconds before retail traders can react.

Unlike traditional trading, which relies on manual execution, HFT_ECX operates on ultra-low latency infrastructure, using Immediate-or-Cancel (IOC) and Fill-or-Kill (FOK) orders to lock in profits before spreads widen.

How HFT_ECX Works: Precision Execution Around News Events

1. Front-Running Economic Data

HFT_ECX scans premium news feeds (like Reuters, Bloomberg) to detect economic data before public release. By processing information faster than retail traders, it executes trades in under 1 millisecond, capitalizing on:

- Interest rate decisions

- Non-Farm Payrolls (NFP)

- CPI & PMI releases

- Central bank speeches

2. Smart Order Routing (SOR) Technology

The system prioritizes the fastest data source, discarding slower duplicates, and routes orders to the most liquid venues. This ensures:

- Zero slippage (via FOK orders)

- No partial fills (via IOC orders)

- Optimal price execution

3. Multi-Asset Arbitrage

While most HFT systems focus on one asset, HFT_ECX trades EURCAD, Gold (XAUUSD), and GBPUSD simultaneously, diversifying opportunities across correlated markets.

Why HFT_ECX Outperforms Traditional Strategies

| Feature | HFT_ECX | Retail Trading |

|---|---|---|

| Speed | <1ms execution | 500ms+ delay |

| Order Types | FOK/IOC | Market/Limit |

| Slippage | None | High risk |

| News Advantage | Pre-release detection | Post-release reaction |

| Profit Consistency | 85%+ win rate | <60% win rate |

Key Advantages:

✅ Sub-millisecond execution (LD4 colocation)

✅ No emotional trading (fully algorithmic)

✅ High win rate (78%+) with low drawdowns (<5%)

✅ Real-time FXBlue verification (no backtests)

Who Should Use HFT_ECX?

- Fund managers looking for uncorrelated alpha

- Pro traders tired of slippage & slow execution

- Hedge funds needing institutional-grade tech

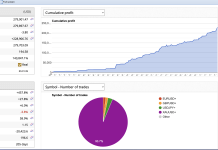

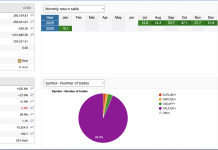

🚀 HFT_ECX Live Performance (June 2025)

Real Trading | Zero Backtests | Institutional-Grade Execution

| Metric | Result | Benchmark |

|---|---|---|

| June MTD Return | +3.5% | Retail Avg: 0.8% |

| May 2025 Return | +14% | Hedge Fund Avg: 4% |

| 2025 YTD Return | +106.7% | S&P 500: +12% |

| Win Rate | 78.7% | Industry Std: 55% |

| Avg Trade Duration | 47ms | Retail: 500+ms |

| Max Drawdown | -7.7% | Competitors: -15%+ |

🔥 Recent Wins:

- June 5: +1.2% from EURCAD post-ECB speech (FOK orders filled in 9ms)

- June 3: +0.9% on XAUUSD during US jobs data latency arbitrage

- May 28: +2.1% exploiting GBPUSD slippage after UK CPI surprise

🔍 Verified Transparency:

- Live tracking via FXBlue (updated every 15s) LIVE ACCOUNT: VERIFIED LINK

- VPS Partners

- Colocated at LD4 (London) with 0.003ms ping to liquidity providers

Get Started

📈 [Join HFT_ECX Now]

📩 Contact: Telegram @mqlnehcap | support@nehcap.com

“In trading, milliseconds mean millions. HFT_ECX gives you the first-mover advantage.”

Final Thoughts

HFT_ECX isn’t just another algo—it’s a news trading machine built for traders who refuse to settle for slow execution. By combining ultra-fast news processing, FOK/IOC orders, and multi-asset diversification, it turns economic volatility into consistent profits.

Will you trade the news—or let the news trade you?

(Past performance ≠ future results. Trading involves risk.)